Is it big? Yes. Is it bold? Yes. And we can get it done.

President Joe Biden on the American Jobs Plan

Fact Check: these are all true.

At the Carpenters Pittsburgh Training Center, President Biden formally announced his $2 trillion plus “American Jobs Plan” (AJP) targeted at increasing growth in jobs for the US economy. This is not merely an infrastructure plan, but truly a wide ranging spending plan covering a gamut of goodies areas outside of roads, bridges and tunnels. Candidate Biden proposed many of these during the campaign and is following through on those promises. Unlike the stimulus plans passed over the last year, this spending plan has tax hikes to help pay for some of the outlays. Keep in mind, there will be another spending plan shortly on healthcare/human infrastructure and it will likely be similar in size. What follows is a brief look at the proposals.

Taxes

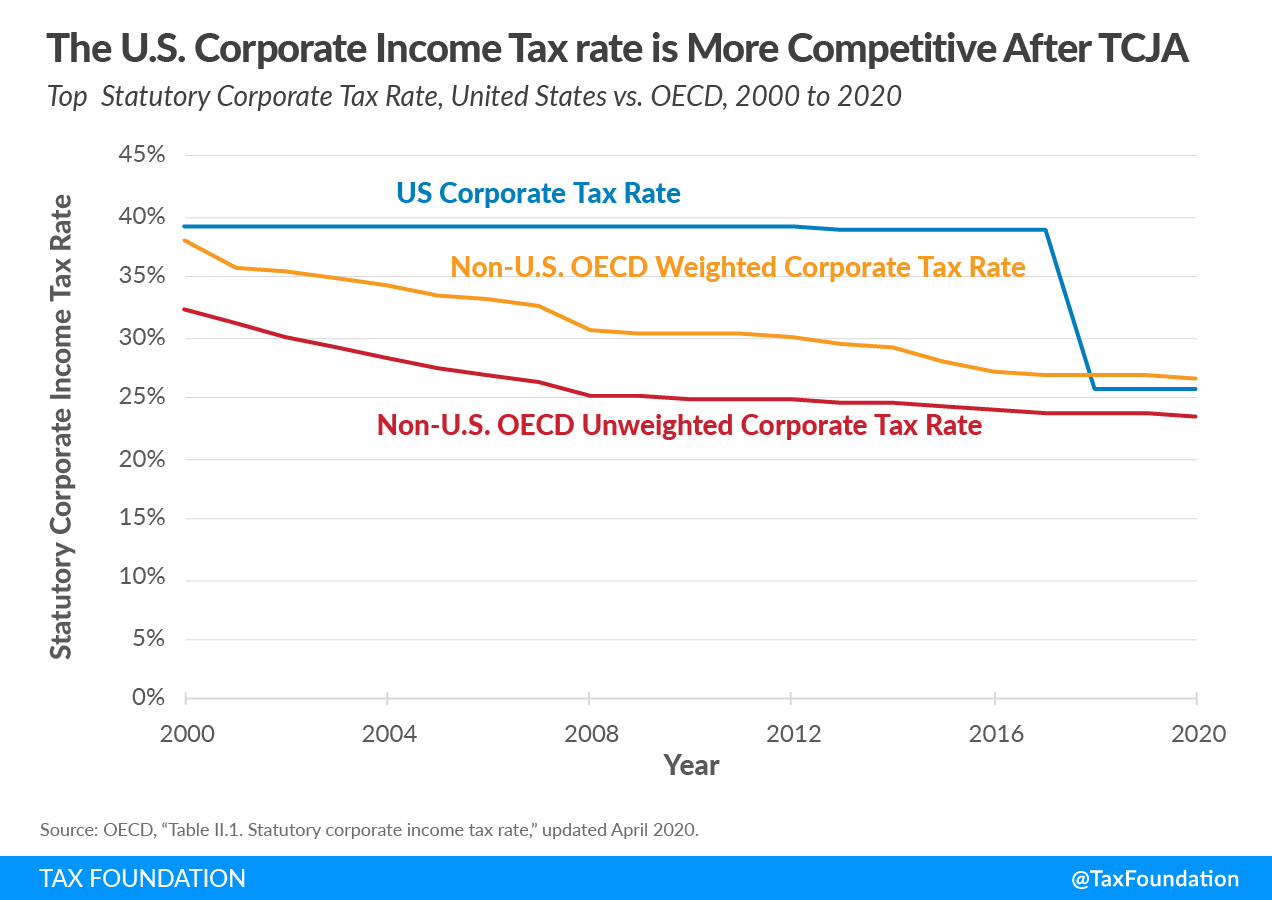

Let’s start with the tax hike. Under the Tax Cuts and Jobs Act (TCJA), the corporate tax rate was cut from 35% to 21%. Remember, this is the corporate tax rate not the passthrough tax rate for LLCs and Subchapter S entities which flow to individual tax rates. Also, under TCJA, many deductions and offsets were eliminated to make the tax code more efficient and giving the actual tax a bigger bite. The goal of the TCJA was to make the US more competitive with foreign corporate tax rates around the world.

Currently, the US corporate combined federal and state tax rate is 25.8% according to the Tax Foundation and the graph below shows where we are right now compared to the rest of the world.

Biden’s plan is to raise the corporate tax rate to 28% and create a combined (federal and state) average of 32.4%, making the US uncompetitive again.

There are other provisions under the AJP like a 15% minimum tax on book income of large corporations and making it more difficult for US companies to invert, but raising the overall tax rate will have the biggest impact.

Spending

Before we get to the actual spending, let’s do a quick timeline on this plan. This is a spending and tax plan subject to Congressional reconciliation rules, meaning it can pass with only 51 votes in the Senate. But all Democrats will need to be onboard with no Manchin of Sinema holdouts. Expect Biden to provide a full-budget by May, Congress to pass budget resolution by end of May, and House-Senate reconciliation done by mid-September.

The spending is large, and the lobbying will be fierce. Below are the big numbers and where the money flows.

Transportation infrastructure

Total of $620B for surface transportation like highways, rail and roads.

$85B would go toward mass-transit systems

$80B is set aside for addressing Amtrak’s repair backlog

$25B on airports

$17B on ports, waterways and ferries

Water infrastructure

$111B replacing all the lead pipes in the US

$100B expand broadband internet access with a focus on rural areas

Climate Change

$174B in electric vehicles (EVs) incentives for consumers, charging stations, shift federal fleet (Post Office) and mandate federal buildings only use clean energy sources

$100B for the electrical grid and a national electricity standard for carbon-free power by 2035

$200B for housing to build/retrofit 1M homes for energy efficiency

$40B for existing public housing

Healthcare and Education

$400B for expanded healthcare access for elderly and disabled people

$100B workforce development programs

$100B upgrades for existing and building new public schools

Manufacturing plus R&D

$180B funding for research and development ranging from semiconductors to advanced computing with a target to fight climate change

$300B mitigate damage from future pandemics, increase production of semiconductors and encourage/support domestic manufacturers

If you just said WOW…

The AJP is a sprawling proposal which spends federal tax dollars across a wide swath of the economy. As readers of our research, no one should be surprised at the size, scope and targets of this spending/tax increases. We live in extraordinary times for US government spending. The four stimulus bills created over $12T worth of fire power for the US economy. This spending plus the vaccines/reopening will likely create 2021 GDP growth near 6.5% for the entire year. The Biden AJP attempts to address what will happen when that stimulus begins to rundown and the economy slows to a 2.5-3.0% trend rate. Remember, this flow of federal dollars will begin in 2022, just in time for the midterm elections.