Hint: it’s rising interest rates

Let’s get to the elephant in the room for most investors: volatility.

To begin, let’s talk about where we’ve been.

GME, TSLA, and (insert your favorite tech stock or SPAC) stock prices have given investors the thrill similar to parenting a teenage boy driving. You can’t steer or brake while your son, who’s brain won’t be fully formed until 25, takes you for a ride. And you’re amazed that somehow, you stay on the road.

The guardrails to this experience remain the Federal Reserve and fiscal stimulus. As we’ve been writing research since May last year, these are so uniquely large that sometimes it’s difficult to put into perspective or context for investing purposes. Yet, the overwhelming takeaway is that the combination has fueled the rally with the delivery of rapid growth as COVID comes under control and the potential for a complete re-opening of the economy.

And it all worked incredibly well for 2020 as stock prices rebounded rapidly and went to all-time highs, while bond yields remained subdued. All great.

Next, let’s talk about right now.

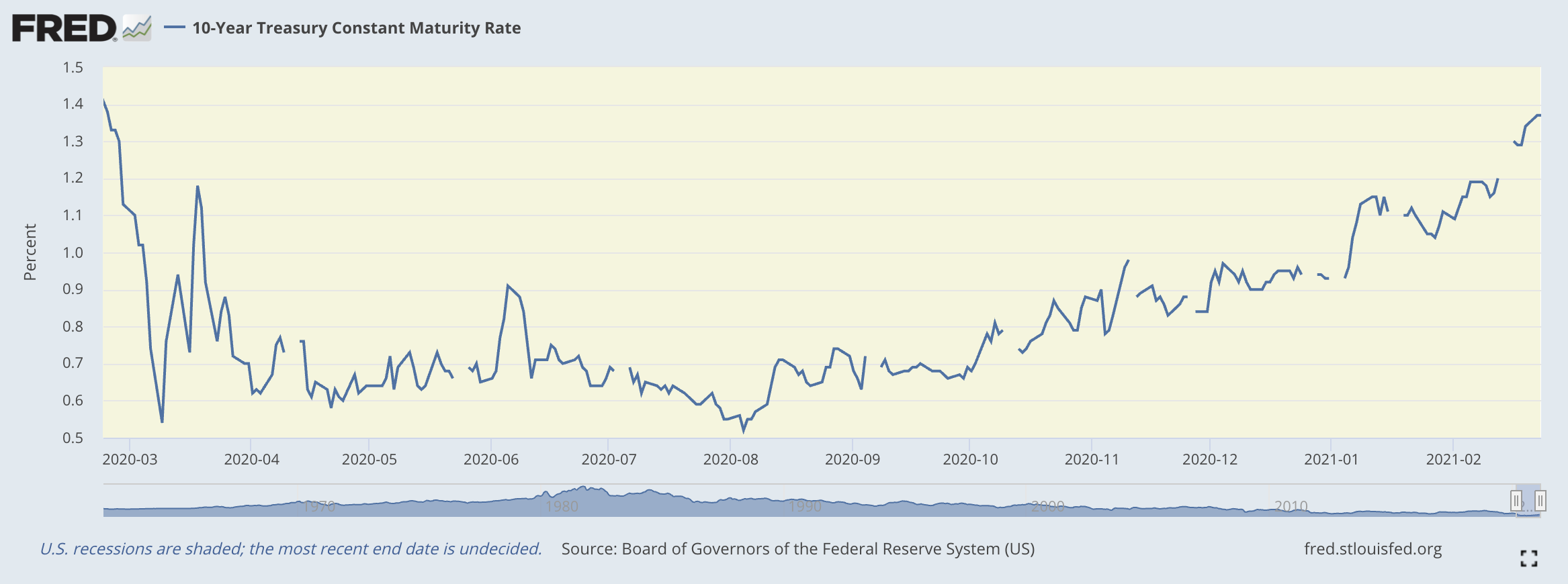

2021 is a different road. The US 10yr Treasury yield has surged. Since bottoming below 0.50% in August, the yield has risen to 1.45% today. We should be more surprised that rates didn’t rise faster as the economy has boomed and wave after wave of massive stimulus has been approved by Congress.

While leisure & hospitality, transportation and entertainment venues have suffered, the rest of the economy is rocking. The warning signs of inflation are now showing up on our economic road. US Stock prices are rising rapidly with speculative pursuits deified in the media. (See Cathie Wood) Housing prices are soaring outside of major cities with lumber prices rising 280% since last April. Producer prices in January rose at their fastest rates since the current series began back in 2009.

This week is emblematic of the changed structure of the market narrative. Since the start of the year, stocks and bonds have shifted their focus from “will the US economy recover?” to “how do we price in 5% GDP?”

This shift is also occurring at the Federal Reserve. This week, Chairman Jay Powell has said the central bank is not overly concerned about inflation and believes it’s transitory. However, he did finally state the obvious: “It’s true that overall asset prices, I would say, are somewhat elevated.” As recently as January 27th, Powell said they were moderate. This is miles away from Alan Greenspan’s “irrational exuberance” comment in 1996, but investors should take note.

My belief is, like all good politicians, Powell is telling his audience on Capitol Hill what they want to hear. The Fed will keep its foot on the monetary gas until all 10 million COVID related job losses are wiped out. Yet, we know the central bank will adjust policy as conditions warrant.

And those conditions will change and change rapidly should Congress approve a $1.9 trillion stimulus program. The House is expected to pass it on Friday with the Senate likely to water it down to $1.5 trillion.

Finally, let’s look into the future.

All of this will continue to push the market narrative of rising GDP growth, rising inflation and rising interest rates. 1.75% on the US 10 year Treasury should be a short-term inflection point for stocks, if not sooner. This reminds me a lot of 2018 where we anticipated great things from the TCJA for stocks leading up to the signing of the law, then had a volatile year when the law went into place.

It doesn’t mean the world is coming to an end. It just means our ride is moving from the autobahn to off-roading. We’ll still get there, but strap in.