By Andrew Busch and Leah Hamilton

In the second part of our series on the re-opening of the US economy, we tackle an area severely impacted by the virus: commercial real estate.

These are our three COVID-19 questions that we set out in our first article:

- What have you done to overcome the shutdown?

- What have you done to adapt during the shutdown?

- What can you do to thrive after the reopening?

During the virus outbreak, the Federal government solution was to act aggressively by suspending non-essential business and travel throughout much of the country. Due to large numbers of domestic and international travel connections, COVID-19 began spreading initially in many major cities throughout the world, as well as within the United States. With large populations in those US centers, Seattle, San Francisco, Chicago and New York City then experienced the largest outbreaks and deaths. Not surprisingly, these are also major centers for commercial real estate (CRE) and therefore, CRE is also one of the major economic sectors that has been severely impacted.

CRE covers a large swath of the US economy from office buildings to industrial warehouses. It’s estimated that monthly payments to US commercial landlords for apartments, office and retail exceeds $73 billion. (Economist, Green Street Advisors, Marcus & Millichap) Like our previous article on the impact of COVID-19 on the agriculture sector, we’ll give you three core analyses for each sector we analyze: what is the impact now; what trends have been supercharged; and what new directions are forming. These research pieces are not meant to be exhaustive, but to provide an overview of key areas and start the conversation about how the world will look as the economy re-opens. We’re taking a broad view on CRE, knowing that each market is unique and has unique factors influencing it.

Overcome: Current COVID CRE Impact

There are many CRE areas impacted by the virus, but we’ll focus on the three that have been hit the worst by the economic shutdown: retail, hospitality and commercial offices. Since the goal of the shutdown was to minimize physical contact, any business requiring face-to-face interactions were either shut down or were severely impeded. In other words, properties with the greatest human density have been the hardest hit: healthcare facilities, regional malls, lodging, and student housing. (McKinsey) Two of the hardest hit types of real estate are retail and hospitality (food service and lodging).

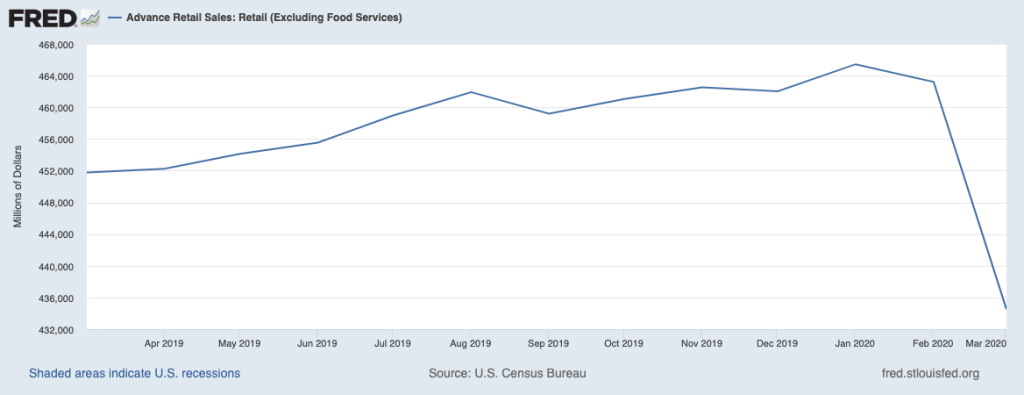

For retail, all non-grocery stores were effectively closed as shoppers would not attempt to enter the stores, and employees faced the risk of contracting the disease. The chart below shows the US March Advance Retail Sales and is emblematic of what has happened to the US economy. The index fell 8.7% in March and further declines will occur in the April data.

Source: Federal Reserve of St. Louis

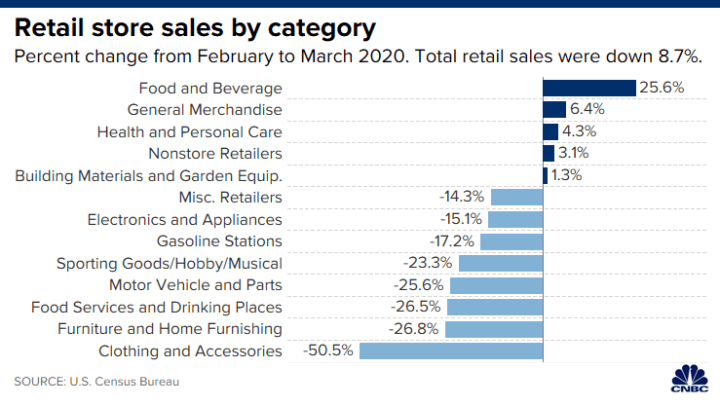

The next chart provides the breakdown of the groups that comprise the index, and also shows the breadth of the impact across multiple industries including food services and drinking places (hospitality).

Source: CNBC

Unsurprisingly, US non-store retail sales rose by 3.1% in March, as shoppers went online to buy healthcare products and groceries. In addition, food and beverage (grocery store) sales surged as consumers stayed home and bought staple and raw ingredients to make meals at home.

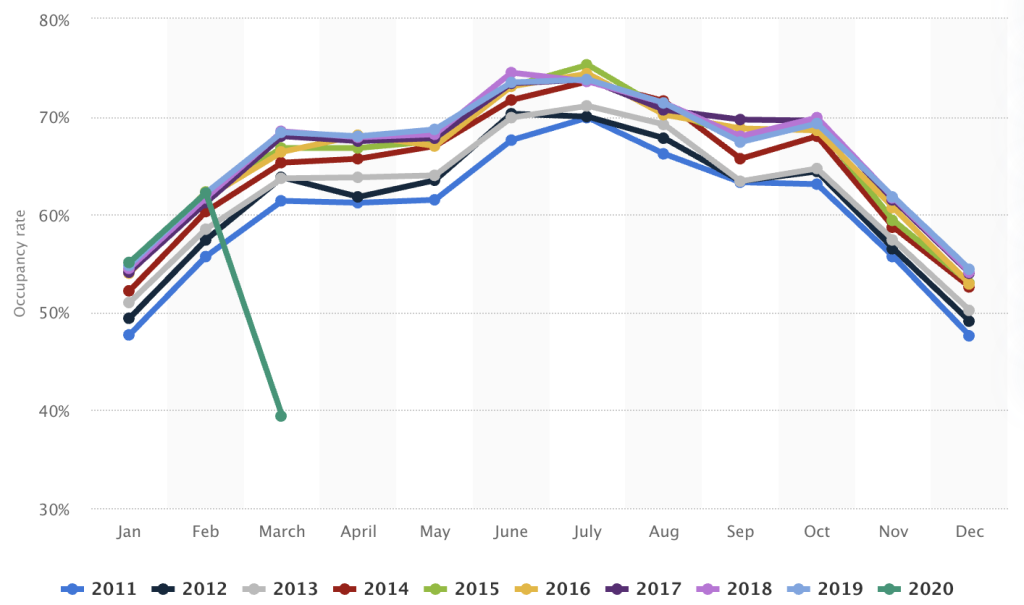

For hotels, the chart below shows the US hotel occupancy rate from 2011-2020, as well as the stunning 42.3% decline in occupancy in the month of March.

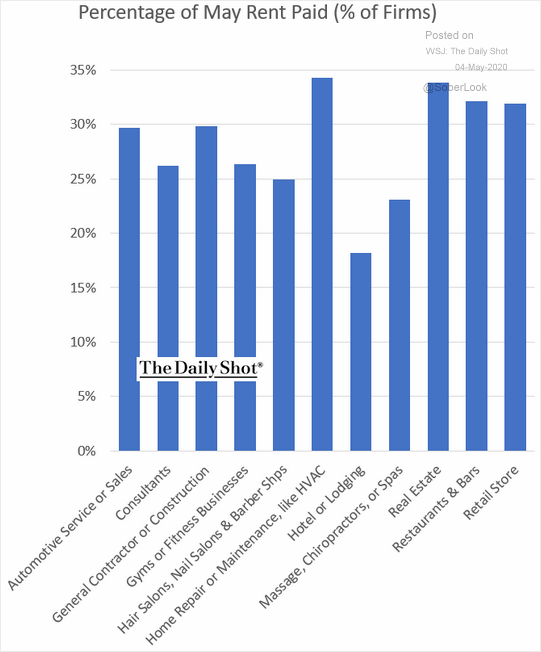

Unless you were deemed an essential business or an essential worker, office employees were furloughed or fired. Others were fortunate enough to continue working from home (WFH). For the latter WFH group, this led to a mass migration away from office buildings, and into homes or apartments. This migration also created chaos for the businesses engaged in running an office building or those leasing an office building. This manifested itself in leases not being paid and a large decline in the price of many CRE real estate investment trusts (REITs). Below is an Alignable survey of its 9,000 members (primarily small businesses) and shows the percentage of May rent payments that continued to be made, broken down on a per-industry basis.

Source: WSJ The Daily Shot

Again, this is not a blanket observation that applies to all CRE REITs. American Tower (multitenant communications) and SVRV ETF (data and infrastructure) are examples of REITs that have continued to perform well despite the shutdown.

In short, the COVID-19 economic shutdown has dramatically impacted three parts of the commercial real estate landscape: retail (malls and stores), hospitality (food service and lodging) and offices.

Adapt: Prior CRE Trends Supercharged & Paused

Note: For the purposes of this article, we’re going to assume COVID-19 therapies will be developed within the next several months, and that a vaccine will be created within the next year.

There were several major trends already impacting the CRE space prior to the outbreak, and we will focus on three of those. All of the below are existing trends and interesting drivers that were present in the CRE industry, and will now shift or adapt in some way.

1. Retail Apocalypse

2. Companies moving into cities

3. Work from home (WFH)

Retail Apocalypse

The history of US brick-and-mortar retail store closings began around 2010 and was continuing to accelerate through 2019. In 2019, US retailers had already announced a staggering 9,302 store closings (a 59% increase from 2018), which was the highest number of closings since Coresight Research began tracking the data in 2012. (CNN) Changing consumer habits (demand for experience-spending) and the “Amazon” effect have played a role in this decline for retail.

With the virus outbreak and shutting down of the US economy, 2020 will likely have a significantly larger impact as COVID supercharges this trend by driving bankruptcies and continued store closings. Amazon, Walmart, FedEx and UPS (along with large grocery chains) have been beneficiaries of this trend with an increased demand for warehouses stemming from on-line orders.

Companies Moving into Cities Pause & WFH is Supercharged

At the beginning of 2020, Deloitte surveyed 750 CRE executives in 10 countries and had this major insight for the coming year:

Tenant preferences are changing, due to increasing urbanization and globalization, changing workforce demands, such as flexible location and workspaces, and technology advancements, such as AI and Internet of Things (IoT).

Chicago serves as an interesting example of these trends. Over the past five years, 17 Fortune 1,000 companies have relocated their headquarters to Chicago from somewhere in the nine-county region, and another 21 have moved in from outside the region, according to World Business Chicago. (Chicago Tribune). This trend was occurring because these companies wanted access to highly skilled workers in Chicago.

Millennials have typically preferred to stay in Chicago and enjoy the amenities afforded by the city: bars, restaurants, theatres, concerts, and sporting events. Due to the virus, these have all been shut down and will not likely see a quick reopening due to ongoing concerns with safety. If these perks of city living are lost, will highly-skilled workers and young people continue to want to live in a city? At a minimum, the movement of large corporations into major cities will halt or slow down until we have an answer to this key question.

It’s doubtful the 750 CRE executives surveyed by Deloitte would’ve seen the demand for flexible location and workspaces transmogrify into the COVID-driven “everyone-who-can-work-from-home-work-from-home” phenomenon. However, this trend had already been in place since the 1980s, and had begun to gain increased momentum with the passing of the 2010 US government Telework Enhancement Act. This law sought to make remote work or telecommuting secure and effective for Federal employees. In the current world in which we are dealing with a serious virus (and the potential for future, similar viruses) the shift to WFH will likely be permanent as workers adjust and businesses adapt. This has massive demand implications for office spaces in downtown, dense urban regions.

At a minimum, this shift will accelerate the use of “hoteling” for office space, where WFH employees make a “reservation” at an office (such as a co-working space) to use a conference room or have a client meeting. This will lead to decreased overall space demand. On the other end of the spectrum, WFH will no-doubt temporarily decrease the demand for office space in dense areas until COVID-19 therapies and vaccines are developed.

Thrive: New CRE Directions

Another disclaimer: As one can surmise, the future CRE demand will be challenging to predict without knowledge of COVID-19 therapies or vaccines. Even if we have them, the potential for a future viral event will remain. Our “New CRE Directions” is predicated upon the current change continuing into the future.

Three new directions for CRE:

- Touchless building tech, and temperature screening building tech

- Increased focus on health and safety issues for buildings and their design

- Demand for offices away from cities (suburbs) and industrial demand for redundant/backup facilities with potential for reshoring of manufacturing.

Building Technology

Forbes notes that “the post-Covid re-ordering will almost certainly have unexpected upstream effects as well, including how architects envision the new definition of “home” after months of people sheltering in place. This will take the form of more touchless technology in high-rise buildings, [and] an increased use of remotely accessible technology like locks and thermostats.” (Forbes) This technology is also highly likely to boom in the commercial real estate industry, with architects and designers re-designing buildings to allow greater spacing between people, and increased use of touchless technology in office spaces and shared areas.

In addition, “certified buildings with proper air filtration are something that people are going to be much more aware of. … There will also be a lot more attention to cleanliness and the need to be a lot more careful about high-touch surfaces in buildings. There are going to be some interesting new technologies around hologram keypads so that people don’t have to touch elevator buttons.” (NAIOP)

Building Design

Diseases and their impacts have long been a factor in how we design our spaces, “from antibacterial brass doorknobs to broad, well-ventilated boulevards, our cities and buildings have always been shaped by disease.” (Guardian) Gregory May, executive vice president and West Region market leader for Newmark Knight Frank noted that “when people do return to the office, the spaces will probably look somewhat different. … There might be some density issues where they want to be separated a little more,” which “could change the layout of office space.” (NAIOP)

On the flipside, the importance of the office as a collaborative space might be able to be more clearly seen, as “people often come together because they want to connect. … . The emergence of coworking is really turning the whole design of the office upside down.” When people have spent a lot longer working from home during the COVID-19 pandemic, “people are going to question why they commute when they can do what they need to do at home.” This means that “to attract people to a building, you’re going to have to make the experience a lot richer and more convenient.” (NAIOP)

In addition, to allow these social interactions to continue to take place, measures such as more openable windows, fewer open-plan spaces, and an increased focus on health and safety requirements and considerations for commercial buildings and their occupants is likely to take place. The standards and requirements that buildings need to meet to be sold or rented could change what building designs and structures look like. Building owners are also much more likely to need to have measures in place to show and preserve a clean and safe work environment. (NAIOP) To move forward in this sector, architects will need to “take the best of what they’ve learned from virtual working to help create office spaces that allow for a balance of isolated concentration and productive, meaningful collaboration.” (Architectural Digest)

Demand away from cities and reshoring

As stated in the previous section on cities and WFH, we are likely to see a halt to the demand for large companies moving back into urban centers if their workers want to leave. How quickly workers regain trust in public transportation could have a lasting impact on commuting patterns, residential markets, and where companies ultimately choose to locate. (Jones Lang LaSalle, Chicago Tribune) This could be a short-term phenomenon if a cure for COVID-19 is quickly found. However, for workers forced to live in close proximity to neighbors and spending hours with those inside their homes, their desire to remain in dense, urban areas is likely to decrease.

In 1985, the median age of a first-time home buyer was 32. Today, it’s 47. The Millennial cohort of the population is approximately 70 million people, who are entering into a time span of their lives where homeownership typically accelerates from the current 30% to 65%. (GS) A potential shift away from urban areas coinciding with this time period of home buying has the potential to drive a rise in home building in suburbs, as well as a rise in demand to work away from dense areas.

COVID-19 has also demonstrated the significant downsides to a global supply chain. During the outbreak in China, the Chinese government shut down all businesses and travel through key global manufacturing centers in the country. This disrupted the supply chains for many US and global manufacturers who relied upon parts and products from China. As well, China initially cut-off key medical supplies, masks and gloves to outside the country, a move that highlighted a weakness in US healthcare capacity. Lastly, many key pharmaceutical products supplied to the US market are solely produced in China, which poses a great risk to the United States if China shuts down again due to a second wave of COVID-19, or another disease (or, theoretically a completely different event).

All of this drives a likely increase in manufacturing and pharmaceutical production back to the United States. Also, within the US, there will likely be some form of redundancy or backup facilities shifting from dense, urban areas out to sparser areas. This may be a short-term, small-scale trend or it could potentially lead to a larger exodus out of major cities.

Quick Summary

The goal of this research was to provide an overview of key COVID-19 driven outcomes, adaptations and new directions for CRE. There are several disclaimers and several pathways we didn’t discuss due to length limitations. We hope to have created an understanding of where CRE is being impacted, but also, we hope we have created a spark of imagination for where CRE can go. While there are significant shifts likely to create disruption in these markets, there are also tremendous opportunities for those that can take advantage of these new trends.