As the nation prepares for a new president, President-elect Donald Trump and his transition team are in the final stages of picking the personnel to shape and enforce agriculture policy. During the campaign, candidate Trump created an agriculture advisory panel to aid him with issues in this space. Republican Governors Terry Branstad of Iowa, Sam Brownback of Kansas, Jack Dalrymple of North Dakota, Dennis Daugaard of South Dakota, Mary Fallin of Oklahoma and Pete Ricketts of Nebraska were included on a list of advisors distributed by Trump’s campaign and have continued to advise during the transition. Without question, there will be major changes to agriculture and regulatory policy under the new Trump administration. During the campaign, Trump pledged to keep ethanol subsidies (RFS), to separate SNAP from the Farm Bill, and to eliminate the “Waters of the United States” rule.

Here are key agriculture takeaways:

- The EPA’s Waters of the US rule, the Department of Labor’s overtime rule, and GMO labeling will all be scrutinized for changes.

- A major boost in US ag exports from TPP will not likely happen. However, there will be both a strong possibility of trade friction with China and potentially a move to rework NAFTA. This would impact four out of the top five markets for US ag exports: Japan, China, Mexico and Canada.

- Congress will begin work on the 2018 Farm Bill. Also, any substantial consolidation within the food industry will receive a close examination for anti-trust enforcement by federal agencies.

- Immigration will likely get attention as a Trump priority. Components of Trump’s immigration policy include: building a wall on the Mexico-US border, enforcement of all immigration laws, and reforming the immigration system.

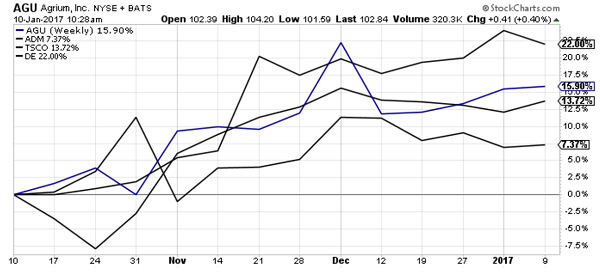

What follows is an overview of the specific targeted areas and the critical players involved. Given there will likely be delays in nominating the head of the USDA, the Trump administration will find it challenging to have an immediate impact on the agriculture sector. However, there is a sea change coming for regulations and tax reform. In anticipation of these changes, many key agribusiness stock prices have moved higher. Below is a weekly 3-month chart for Agrium, ADM, Tractor Supply Company, and Deere & Company showing strong increases since November 8th.

Key Government Players and Agencies

Below is a list of some key positions in the Trump administration (and nominees if announced), regulatory agencies, and Congressional Committees involved in the agriculture sector.

US Department of Agriculture (USDA) likely nominee Sonny Perdue (5 under consideration)

US Treasury Secretary nominee Steve Mnuchin

US Commerce Secretary nominee Wilbur Ross

US Secretary of the Interior nominee Ryan Zinke

National Economic Council Director Gary Cohn

Federal Reserve Janet Yellen (term ends 2018)

Department of Labor nominee Andrew Puzder

US Trade Representative Robert Lighthizer

US Ambassador to China Terry Branstad

National Trade Council Director Peter Navarro

Department of Energy (DOE) nominee Rick Perry

Environmental Protection Agency (EPA) nominee Scott Pruitt

Regulatory Advisor Carl Icahn

Commodity Futures and Trading Commission (CFTC) Christopher Giancarlo, ranking Republican

House Ag Committee Chair K. Michael Conaway (R-TX)

House Ag Committee ranking minority Collin C. Peterson (D-MN)

Senate Ag, Nutrition & Forestry Committee chair Pat Roberts (R-KS)

Senate Ag, Nutrition & Forestry Committee ranking minority Debbie Stabenow (D-MI)

Food and Drug Administration (FDA)

Farm Credit Administration

Food Safety and Inspection Services (FSIS)

Key Issues

Trade Agreements. During the campaign, candidate Trump stated he would:

- Kill the Trans Pacific Partnership (TPP) trade deal.

- End NAFTA.

- Impose 35% tariff on imported autos and auto parts from Mexico.

- Impose 20% tariff on imported goods.

- Impose a 15% tax on outsourced jobs.

- Declare China a currency manipulator and begin the process of sanctions.

Also, he has mentioned a willingness to pull out of the World Trade Organization (WTO) and 20 current free trade agreements. As decreed by the US Constitution and Congress, the office of the US President has tremendous leeway to negotiate trade agreements and to place tariffs on goods. To leave NAFTA, Trump can simply provide 60-day notice to Canada and Mexico of his intent to withdrawal.

If Trump were to follow through on his threats over free trade and tariffs, the US could be involved in a trade war. According to the Peterson Institute for International Economics, this would plunge the US economy into recession and cost more than 4 million private sector American jobs. Moreover, “…export-dependent US industries that manufacture machinery used to create capital goods in the information technology, aerospace, and engineering sectors would be the most severely affected. But the shock resulting from Trump’s proposed trade sanctions would also damage sectors not engaged directly in trade, such as wholesale and retail distribution, restaurants, and temporary employment agencies, particularly in regions where the most heavily affected goods are produced.”

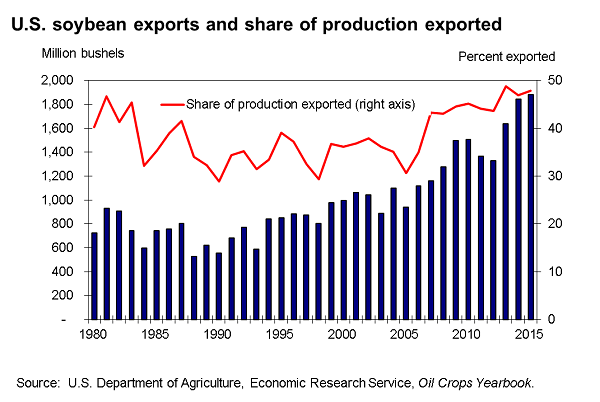

In the agriculture sector, the United States is the world’s largest producer and exporter of soybeans, according to USDA. “Oilseed and oilseed product exports, particularly soybeans, represent a significant source of demand for U.S. producers and make a large net contribution to the U.S. agricultural trade balance. Among all U.S. agricultural products, only grains and feeds outrank the oilseed sector in total export value and volume.”

The main export destinations for U.S. oilseeds, oilseed meal, and vegetable oil include China, the European Union (EU), Japan, Mexico, and Taiwan. A trade war with either China or Mexico could severely disrupt these important soybean export destinations. In a recent letter from 16 agriculture associations to president-elect Trump, the groups stated: “Existing (export) markets include China, Canada, and Mexico— U.S. farmers’ first, second, and third largest foreign customers. U.S. agricultural exports in FY-2016 were nearly $27 billion to China, over $24 billion to Canada, and nearly $19 billion to Mexico. Disrupting U.S. agricultural exports to these nations would have devastating consequences for our farmers and the many American processing and transportation industries and workers supported by these exports.”

Regulations. During the Obama administration, regulations are estimated to have cost $743 billion and required 11.5 billion in work hours (American Action Forum). During the campaign and after, Trump pledged to reduce the regulatory burden on US business. At his acceptance speech for the Republican nomination for president, he said, “We are going to deal with the issue of regulation, one of the greatest job-killers of them all. Excessive regulation is costing our country as much as $2 trillion a year, and we will end it very, very quickly.” A President Trump, on his first day in office, can also declare a moratorium on all new regulations, as President George HW Bush and President George W Bush did.

For the agriculture sector, the EPA’s “Waters of the US rule,” which dictates which waterways come under the Clean Water Act, is particularly troublesome and a good example of what can happen under a Trump administration. In a September speech, Trump called for eliminating the rule and declared it as among the federal government’s “most intrusive regulations.” Sen. John Hoeven, (R-ND) said there are three ways to repeal the rule.

- Congress could rescind it legislatively next year.

- The new administration could rescind it through the rulemaking process.

- The Sixth Circuit Court of Appeals could strike it down.

There is a fourth way: the new head of the EPA can simply choose not to enforce the rule and tell the agency regulators not to pursue it or to slow-walk any enforcement of it. The Clean Power Plan and the Paris Climate Agreement are two additional environmental regulatory structures likely to come under review.

Immigration. One of the thorniest issues facing a President Trump and Congress is immigration. During the campaign, Trump made this a focal point and had this 10-point immigration plan:

- Begin working on an impenetrable physical wall on the southern border, on day one. Mexico will pay for the wall.

- End catch-and-release. Under a Trump administration, anyone who illegally crosses the border will be detained until they are removed out of our country.

- Move criminal aliens out day one, in joint operations with local, state, and federal law enforcement. We will terminate the Obama administration’s deadly, non-enforcement policies that allow thousands of criminal aliens to freely roam our streets.

- End sanctuary cities.

- Immediately terminate President Obama’s two illegal executive amnesties. All immigration laws will be enforced – we will triple the number of ICE agents. Anyone who enters the U.S. illegally is subject to deportation. That is what it means to have laws and to have a country.

- Suspend the issuance of visas to any place where adequate screening cannot occur, until proven and effective vetting mechanisms can be put into place.

- Ensure that other countries take their people back when we order them deported.

- Ensure that a biometric entry-exit visa tracking system is fully implemented at all land, air, and sea ports.

- Turn off the jobs and benefits magnet. Many immigrants come to the U.S. illegally in search of jobs, even though federal law prohibits the employment of illegal immigrants.

- Reform legal immigration to serve the best interests of America and its workers, keeping immigration levels within historic norms.

On his first day in office, Trump can roll-back President Obama’s immigration executive orders and direct federal enforcement agencies to step up deportation orders and immigration laws. Trump’s nominee for Attorney General, Jeff Sessions, is a well-known immigration hard-liner.

For agriculture, both processing and production are heavily reliant on an immigrant workforce. New restrictions on this workforce would likely significantly affect rural ag communities. Also, the American Farm Bureau Federation said that in 2016, farmers applied for a record number of guest worker visas and the H2A program has doubled over the last 10 years. At the annual AFBF convention, USDA economist Tom Hertz said Mexican immigration to the U.S. has been declining since 2007, and the number of Mexican-born people in the U.S., legally or illegally, has dropped from 13 million to an estimated 11.7 million in that time.

“The crop workers remaining are getting older: 14 percent were 55 or older in 2013-14, compared to 11 percent in 2007-09. That’s a concern because the ability to do manual labor declines with age, he said. Also, the percentage of workers who are settled in one spot, not migrating from job to job, has increased to 84 percent from 74 percent during that time frame. Hertz said a USDA study compared two immigration reform options. Expanding H-2A ag worker visas would add 156,000 workers to the farm labor workforce, he said, while cranking up deportations would remove an estimated 5.8 million unauthorized workers, 40 percent of the ag workforce, over 15 years. He said removing workers would force producers to pay even higher wages to those left behind, at a time when labor costs as a percentage of farm expenses are leveling off.”

Clearly, immigration will be a difficult choice between fulfilling campaign promises and ensuring there are enough farm workers to bring in harvests.

To discuss further and receive recommendations, please contact Andrew Busch here