At the March 16 Federal Reserve meeting, the central bank left interest rates and monetary policy unchanged. Given the dramatic drop in the global stock and commodity markets over the last quarter, this came as little shock to the markets. Given the continued recovery in the U.S. jobs situation with unemployment falling below 5.0%, there was a belief before the announcement that the Fed might indicate higher rates soon. Yet, what did surprise people in the Fed’s statement was this language: “However, global economic and financial developments continue to pose risks.” Along with this statement, the central bank went further and reduced the board members’ projections for future interest rate hikes in 2016. Why is the central bank so cautious over the international situation?

In a word: uncertainty. More specifically, there are three key areas of international risk the Federal Reserve feels it must consider when approaching domestic decisions over the future path of U.S. interest rates:

- The European Central Bank (ECB) and negative interest rates

- The upcoming UK vote to leave the European Union (EU) (Brexit)

- The U.S. presidential election and its potential impact on trade policy

For business and growth, the Fed’s consideration of international issues shows the importance to U.S. GDP of the global economy. Because exports are a critical component of many businesses in the U.S. and Midwest, it’s important to follow these developments to anticipate how they might affect foreign sales in the coming months and years.

In this article, we’ll briefly cover the key components of these three major risks.

European Central Bank and negative interest rates

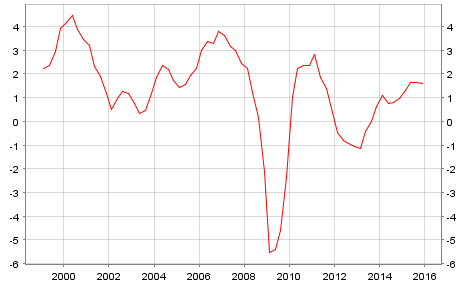

The European economy continues to suffer through slow growth, terrorist attacks and lack of economic reform. The two charts below show the problem the ECB is facing. The first is EU GDP. While it recovered from the 2009 global recession, GDP slipped into negative territory in 2012-2013 and is now growing at just slightly below 2.0%.

Source: ECB

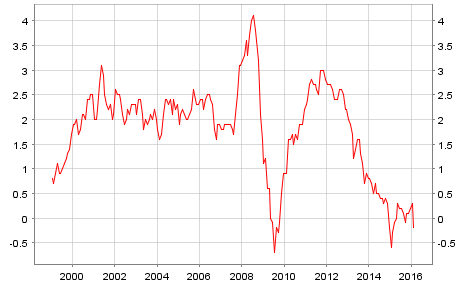

The next chart shows the related problem: inflation is in negative territory.

Source: ECB

The combination of these two developments has led the ECB to lower interest rates aggressively and create a quantitative easing program consisting of buying fixed income assets in a manner similar to the policies of the Federal Reserve. The ECB created negative interest rates on deposits in June of 2014 to encourage banks to lend. In March of 2015, the central bank felt it necessary to start the current QE program. At their March 2016 meeting, they raised the amount of QE and cut interest rates to -0.4%. Again, the negative rates policy translates into banks having to pay the ECB to park deposits at the central bank. All of this indicates of course that the central bank is going to monetary policy extremes to stimulate growth and stave off deflation, and that their policies are not producing what they want.

Brexit on the horizon?

Another major international uncertainty coming from Europe is the June 23 vote in the United Kingdom on whether to remain in the EU as it has since 1973. The EU is the biggest economy in the world with a GDP of $18T, but it is not a state. It is mainly a trading bloc of 28 countries with many rules and regulations, created by politicians and bureaucrats outside the individual countries. While the UK is part of the EU, it is not part of the currency union that utilizes the Euro. The proponents of Brexit believe the UK would benefit from leaving the EU to eliminate job-killing regulations, embrace self-determination concerning regulations and trade pacts, and end a net 6 billion euro transfer to the EU. The opponents of Brexit believe that the UK benefits significantly from the EU relationship and that leaving will cause significant regulatory and trade issues which will damage the British economy and cause trade partners to look elsewhere until the dust settles. As an example a UK employers’ group, the Confederation of British Industry, estimates a Brexit could cost the economy GBP100B (5% of GDP by 2020) and 950,000 jobs.

Worse, the broader question for Brexit would be whether this leads to more EU nations pulling out and creating further economic chaos for Europe.

U.S. presidential election

The 2016 U.S. political season has been a free-for-all of ideas, debates and candidates. While the race is far from over, a troubling international economic issue has come to the surface: the potential for a trade war. The chart below shows the U.S. balance of trade in goods and services. This shows a net negative trade position of between $40-$50B a month. This trade deficit has, in part, given rise to the belief that international trade has hurt the U.S.

The leading candidates for both parties have expressed displeasure with the Trans Pacific Partnership (TPP), a free trade agreement that was negotiated by the Obama administration. While the TPP has not been formally presented to Congress for a vote, candidates Bernie Sanders, Hillary Clinton, Donald Trump and Ted Cruz have all stated their misgivings with the pact and have indicated they would not sign it. Worse, Trump has stated he wants to rip up current free trade agreements like NAFTA and designate China as a currency manipulator. The trade stances by the U.S. presidential candidates are beginning to be noticed not only by U.S. trade partners, but also by the financial markets. Even if these anti-free trade policies do not occur, the markets and our trade partners may well respond to such perceived threats ahead of the election.

What does this mean for growth?

At almost 14% of U.S. GDP, international trade is a key component of the economy and its future growth. For S&P 500 companies, sales outside the United States generate 40% of profits. Therefore, businesses should be keenly aware of what happens outside U.S. borders because global trade, tax, and monetary policies directly impact both sales and profits. As a matter of fact, the Federal Reserve is making international developments a key variable in its deliberations on interest rates and monetary policy. The three issues reviewed above are contributing to a cautious Fed outlook for the U.S. economy.

Moreover, because of the current uncertain environment, business people are reluctant to commit capital to future enterprises. Nor do consumers tend to thrive in this sort of environment. Often they suffer from stagnant or diminishing wages, which in turn diminish their ability to spend. The recent drop in personal income and outlays (spending) has in turn reduced the GDP forecast by the Atlanta Federal Reserve in their GDPNOW service from Q1 GDP of 2.2% at the beginning of March to 0.6% at the end of March. Clearly, the Fed’s caution from international concerns is well founded.