"Andy’s powerful and entertaining talk resonated with our audience. And they asked questions until time ran out. Today, it’s tough to find an objective voice when it comes to the economy and politics, but he’s the one speaker we’d trust to cover these topics anytime."

CONNECTING

TODAY’S CHAOS TO TOMORROW’S GROWTH

Connecting Today's Chaos to Tomorrow's Growth

Keynotes, consulting and research helping you learn from the past, to understand the present and see into the future

The question on everyone's mind today is, "where do we go from here?"

War in the Ukraine Surging Inflation Artificial Intelligence Banking Crises Global Pandemics Supply Chain Disruptions Climate Change Labor Shortages Elections

The list of new challenges to your business and industry feels endless.

Where can you turn to make sense of the chaos so you can confidently make the right long-term decisions?

The question on everyone's mind today is, "where do we go from here?"

War in the Ukraine Surging Inflation Artificial Intelligence Banking Crises Global Pandemics Supply Chain Disruptions Climate Change Labor Shortages Continued Lockdowns

The list of new challenges to your business and industry feels endless.

Where can you turn to make sense of the chaos so you can confidently make the right long-term decisions?

“

"Andrew Busch was a key success factor for our NC Chamber's 79th Annual Meeting. He gave us the ability to understand the future economy and opportunities for growth. Our members gave him a 100% satisfaction rate with a 5.0 rating on a 5-point scale. The success of the event wouldn't have been possible without him."

"Andrew Busch gave our conference deep insights into the economy, providing a roadmap for what’s coming next. His keynote gave our clients the confidence to go past today’s messy economic world to see the future growth opportunities for our industry."

Learn from the Past, Understand the Present, and See the Future

What’s needed is context. You need to know where you’ve been, to understand where you are and so you can see where you’re going.

Our Future Growth Opportunities process helps you move beyond today’s headlines to see the future.

Learn from the Past, Understand the Present, and See the Future

What’s needed is context. You need to know where you’ve been, to understand where you are and so you can see where you’re going.

Our Future Growth Opportunities process helps you move beyond today’s headlines to see the future.

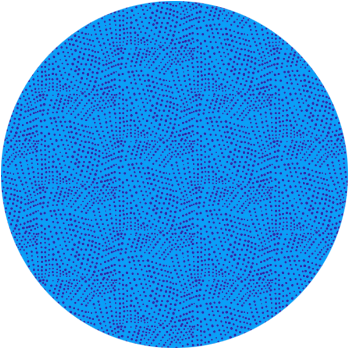

The Future Growth Opportunities Model

Your Future Growth Crystal Ball

Your Future Growth Crystal Ball

Using his Future Growth Opportunities model, Andrew Busch explores the stories and themes driving momentum and the financial markets to offer economic clarity for top organizations worldwide.

Step 1

Learn From the Past

The events of the past provide the valuable context required to accurately shape our understanding of the present and guide our decision-making for the future. By studying historical patterns, trends, successes, and failures, we identify opportunities and challenges, so you can adjust your growth strategies accordingly.

Step 2

Understand the Present

Our Future Growth Opportunities model cuts through the noise, biases, short-term factors, and misinformation to give you industry specific insight into the critical changes that are occurring in real-time and help you understand why they matter to you.

Step 3

Discover Future Growth Opportunities

The FGO model dives deep into the money flows going into your sector to provide you an industry specific case study that outlines specific future growth opportunities for your organization. Move from chaos today to confidence in the future.

Hi, I'm Andy Busch.

If things feel crazy in the world today, that's because they are. We are seeing huge shifts in risk and reward, leading to a lot of economic uncertainty and confusion about where we go from here.

You need context to understand the world we are in right now, which is why I focus on where we've been, where we are, and where we are going so that you can discover industry-specific opportunities hiding within the chaos.

As an economic futurist, I do things a bit differently than your typical economist — going beyond analyzing how today's financial policies impact economic growth, to focus on the super-charged trends driving much of today's global chaos and change.

This unique approach provides you with the context and economic clarity you need to make sense of the past, understand the present, and discover the future growth opportunities you need for continued success.

Get the Research

AI, war, labor supply, supply chain, inflation, government policy, elections, climate change, AEVs, Space? Our research covers it all. Sign up below to understand the trends driving the future economy and growth opportunities.